|

Punch the Clock Day is celebrated annually on January 27. It is a day to recognize the ‘punch the clock’ system of clocking in and out of work. Other names for the punch clock include time clock, time recorder, or clock card machine. Most companies have moved away from the original mechanical time clock to computer-based ones that use smart phone or tablet technology. But the concept is still very much applicable, and while we’ll admit that it is one of the more random holidays, it is a great opportunity to talk about one of the most common problems for workers in the US, Wage Theft. But again a quick history on the punch clock.

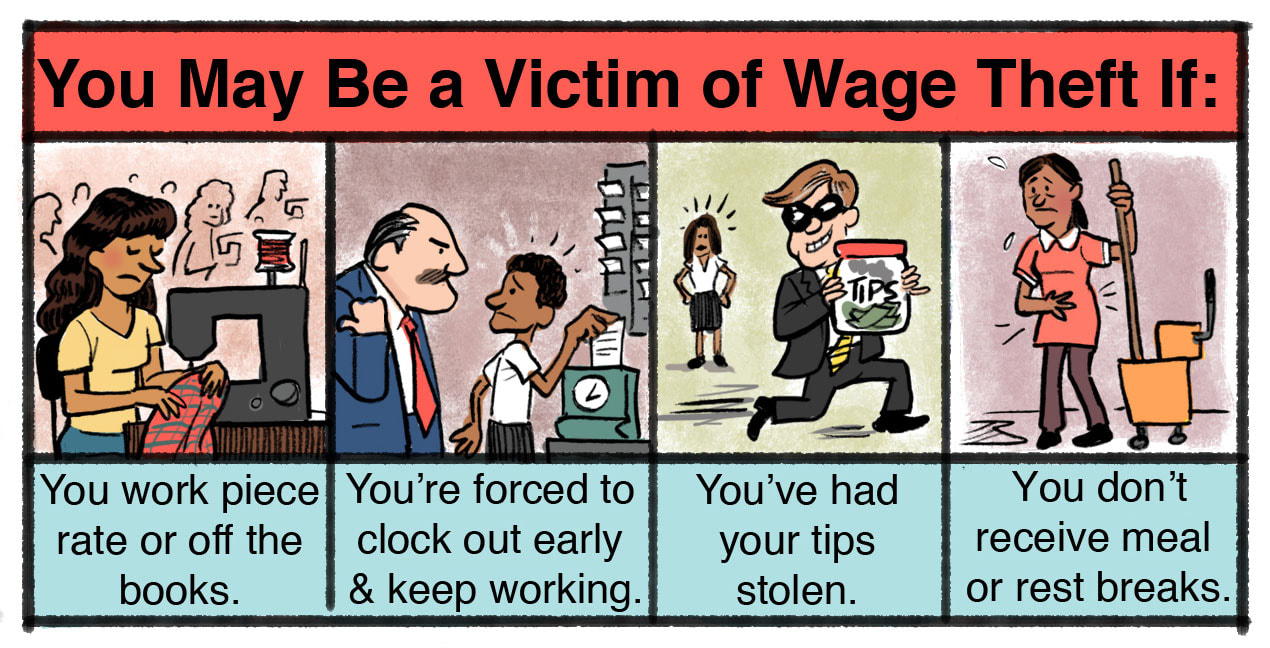

Historically, hourly wages were calculated based on manual data kept by employers. Managers would write down records of hours worked by employees and determine payroll accordingly. This, however, left a lot of room for miscalculation, workplace disputes, and discrepancies in the money paid and money owed. Employers could write down fewer hours to pay less, and employees could claim they worked more to get paid more, with no secondary source to double-check. Then came the Punch the Clock system. In 1888, Willard Le Grand Bundy, invented a clock where employees could punch in and punch out the hours they worked. An employee would punch their card into the clock, with their exact work hours logged onto it. Employees got paid what they earned, and employers only paid what they owed, a revolutionary change in hourly-wage workplaces. Over time, this system has become even more advanced. Due to technological advancements, wage calculating systems have become digitized and more secure and accurate than ever. Employers can invest in software that tracks employees’ hours on their computers, biometric trackers that store employees’ hand prints and eliminate proxy punching, scan unique barcodes on identification cards, and so much more. And supposedly, the system of tracking and paying employees by the hour was supposed to be fair and efficient. Or at least that’s what was supposed to happen. However, issues with workers’ not getting properly paid are so common, I have a colleague’s office practically on speed dial. My friend and fellow attorney Bob DeRose is a Partner at Barkan Meizlish DeRose Cox, LLP. His practice these days is almost exclusively in wage and hour/overtime issues. The following is their information on this issue and your rights from their website (portion in italics); Holding Employers Accountable for Paying Workers Fairly As wage and hour attorneys, much of our work is done under provisions of the FLSA and the Ohio Minimum Wage Fair Standards Act (“the Ohio Wage Act”). For the majority of hourly workers, the federal law mandates time-and-half for each 15-minute increment of work performed in excess of 40 hours during a 7-day week. Questions over who, exactly, qualifies to earn overtime get complicated and the answers change with updates to U.S. government policies. Anyone with concerns about possible unpaid overtime should consult with an attorney. Beginning in 2020, the Ohio Wage Act requires employers to pay most workers at least $8.70/hour for each hour an employee works. Tipped employees such as wait staff, bartenders and dog walkers can be paid $4.35/hour, but their average hourly pay must still total at least $8.70. Every Ohio resident who earns the minimum wage is assumed to be eligible for overtime, even those who take tips. Employers engage in many illegal and deceptive practices to deny employees the minimum wage and overtime pay. Barkan Meizlish DeRose Cox, LLP, are available to assist workers who fall victim to any of the following problems. Miscategorization of Employment Status In order to avoid minimum wage and overtime laws, unscrupulous employers often miscategorize full-time and part-time employees as independent contractors. The federal government and the State of Ohio enforce rules that determine which workers must be paid at least minimum wage and overtime as employees. At their most basic level, those rules treat a person as an employee if he or she reports regularly to a single worksite, works under the direct supervision of a manager employed by the same organization, and depends on the organization for the equipment and resources needed to complete tasks. Kurt’s note - The Independent Contractor game is very common in workers’ compensation too. If you employer says you are one and pays you with a 1099, it is not the deciding factor. In fact the Ohio Bureau of Workers’ Compensation and the Industrial Commission of Ohio look at a 20 part checklist. So if you get hurt and your boss says you can’t file because they don’t have coverage, you can. If they say you can’t file because you’re not an employee call us or another competent attorney. It’s not like they have a whole load of reasons to lie to you, oh no, they do. Misclassification of Eligible Overtime Hours Misclassification occurs when an employer treats an overtime-eligible worker as ineligible for overtime. The legal terms are “exempt” and “nonexempt,” with earning a high salary, supervising co-workers, and/or performing professional duties as evidence of exempt status. Employers sometimes misreport earnings and give a person a professional-sounding job title in order to unlawfully deny earned overtime pay. Off-the-Clock Work Employers cannot require overtime-eligible or hourly employees to do uncompensated work. This means that managers cannot insist that tasks be completed before an employee clocks in or after an employee clocks out. It also means that mandatory unpaid overtime, clocking employees out without their knowledge, and withholding overtime pay as a punishment are illegal. Illegal Deductions of Employee Wages Employers are allowed to make certain deductions from workers’ wages for uniforms, special equipment, and employee-caused losses such as money drawer shortages and damage to company property. However, deducting wages for work performed as a punishment for a policy violation is not allowed. Nor can an employer deduct so much from an employee’s pay that the worker ends up earning less than the minimum wage. Illegal Rounding of Employee Hours Rules put in place to ensure employees get paid for each hour they work require employers to record work time in 15-minute increments. Periods of 1-7 minutes can be rounded down to the previous quarter-hour; periods of 8-14 minutes must be rounded up. Some employers cheat workers by always rounding down. Other employers refuse to record workers’ time in increments shorter than half hours or full hours. Misreporting/Miscalculating Employee Break Time Employees cannot be required to work during unpaid breaks. Also, employers cannot require workers to clock out for breaks that are shorter than 20 minutes. What this means in practical terms is that workers cannot have their pay docked for taking bathroom or other short breaks. Withholding Pay for Employee Travel Time Traveling for work—but not commuting to work daily—is what the law and lawyers call “compensable.” The time spent driving to call on clients must be paid time. So must the day spent flying from headquarters to a business meeting. Overtime accrues while traveling for work, as well. Poor or Fraudulent Record-keeping of Employee Hours and Wages Laws like the FLSA require employers to keep accurate, detailed, and reviewable records of hours worked and wages paid. A worker cannot be held responsible for keeping track of wage and hour details. Employers who misreport worktime and pay cheat workers even when the errors are not made intentionally. A Unpaid Wage Attorney Who Fights for Workers Employees have legal rights to demand fair wages and earned overtime. The laws and regulations that enforce these employee rights, however, also impose tight statutes of limitations. As soon as you notice that your employer is engaging in illegal pay practices, contact the experienced wage and hour attorneys at Barkan Meizlish DeRose Cox, LLP. In addition to explaining your legal options, our Ohio employee rights lawyers can help you identify and obtain essential evidence. Our lawyers may also be able to identify other workers the employer has underpaid and exploited and form a group of plaintiffs that has more influence than one individual. Can I Afford an Attorney? Our wage and hour attorneys understand that when it comes to wage theft, it can feel like an impossible task to go up against your employer. With the cost of attorney fees often outweighing the lost wages in question, many affected by wage theft choose not to pursue legal action. Fortunately, 29 U.S.C.sec 216(b) sets guidelines for fee-shifting. This practice gives employees who successfully bring claims of FLSA violations against their employers the opportunity to have the cost of their attorney’s fees shifted and become their employer’s responsibility. This means that your employer pays your attorney and not you. So, ever had someone try to do this to you or someone you care about? Contact us and we can connect you with Bob & his team to help take care of this. Call us at 419-244-7885. And don’t let an employer take away your workers’ compensation rights by calling you an independent contractor and not filing. Call us and we can look at the facts with you and give you an unbiased take on whether you really are an employee or not.

0 Comments

International Sweatpants Day is marked on January 21 every year, and I’m going to celebrate it by wearing my sweatpants that day. First let me tell you about the history of those comfy pants and then why I care .

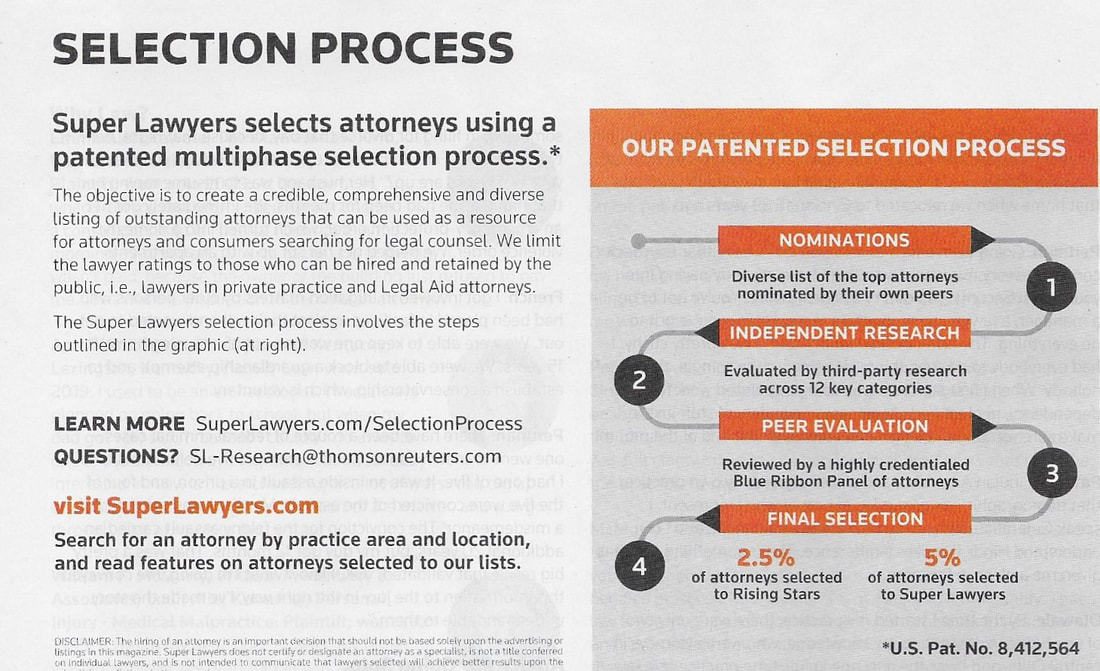

Until I researched this post, I didn’t know this, but the first pair of sweatpants was introduced in the 1920s by Émile Camuset, the founder of Le Coq Sportif. The first sweatpants to be made were simple knitted gray jersey pants that allowed athletes to stretch and run comfortably. Since then, traditionally, sweatpants have been ash-gray in color, but over the recent years, companies like Nike, Champion, Under Armor & others have put considerable effort into making them more attractive while at the same remaining just as comfortable as the original ones. Despite the fact sweatpants were made for exercise, people wear them for the exact opposite reason, to relax! And I will admit, when I come into the office alone to get some work done, it’s going to be in jeans or sweats. Thanks to virtual hearings being the norm these days, I can get away with a bunch more casual clothes than any time in my career. But again, by now, you have to be saying, again, Kurt why this blog. Well I want to tell you a story, it’s about my wife’s former church and a person who attended there. But it also applies to our clients. In case you don’t know my wife is a United Methodist Pastor. She currently serves as a Spiritual Care Coordinator or some call them Chaplains for Hospice. But when we first met she was serving a small, but growing church in Findlay, just under an hour south of Toledo. At the time, she was sent there to turn the church around. It, like most mainline churches had been declining for years. But she was sent it to turn the tide and she did at that church and her next one as well. Methodist pastors usually move around a lot, but because of me, she was to stay within an hour or so of Toledo. Thanks to the good work she and the church were doing, she started to attract people who didn’t have a church home. One of them we’ll call Roger. Roger came to church every week for a time, wearing sweatpants, would stay for the small group, Sunday school class, and then leave every week. Finally, I got the courage to ask him why he didn’t stay. He explained that he didn’t think it was right for him to come into the service in sweatpants and right now, that’s all he had. This was not a church where everyone dressed up. Sure there were older members of the congregation in fancier clothes, but lots of people in khakis and the like. I offered to get into my sweats, as the pastor’s new spouse who was generally well liked and sit with him. I told him no one would say a word and he’d see we were OK with that. But he never did. Not too many weeks after he died. And we found out a bit about him that we never knew. We knew he had battled some dark times, and struggled with substance abuse. But what we never knew, until his family, who had just started to reconnect with him before he died, told us was Roger was not a poor, addicted man all of his life. Before he had been a successful CEO, who yes owned fancy suits and lived in a large home. But things crumbled and he literally lost everything, including the clothes on his back. So at the end, he truly only had sweatpants. He died never feeling like he could be a part of our church fully. And I can tell you that truly opened my eyes. If anyone needed that church fully it was him. I can tell you that Cheri has served or we have attended four churches since then. And I make it a point every so often to dress in sweats, jeans, a t-shirt or the like. Why? Because I want the other Rogers of the world to feel at home. We spend all day around here helping people who are in dark places financially, and we don’t judge you by what clothes you show up in. I have had clients who were housing insecure or flat out homeless. I have had people shake my hand with greasy, dirty hands, wearing dirty coveralls, etc. And a few clients who showed up for any appointment in sharp suits. Just know, we treat you all the same around here. Because you deserve that. When clients talk to me at the beginning calling me Mr. Young or Sir, I quickly say thank you for the respect. But I am Kurt, and I want you to get used to a guy with a suit being on your side. So this Sunday, I’ll be in my sweats for church. And I’m pretty sure my pastor and my wife will be OK with that. For the Tenth Year in a Row Kurt Young has been named an Ohio Super Lawyer in Workers' Compensation Law. In order to be named you have to be nominated, be vetted by a research team, and rank as one of the top 5% of the attorneys in your area of practice in your state and area of practice based on survey of past winners and other notable attorneys. To Qualify you must have over 10 years in practice and be nominated.

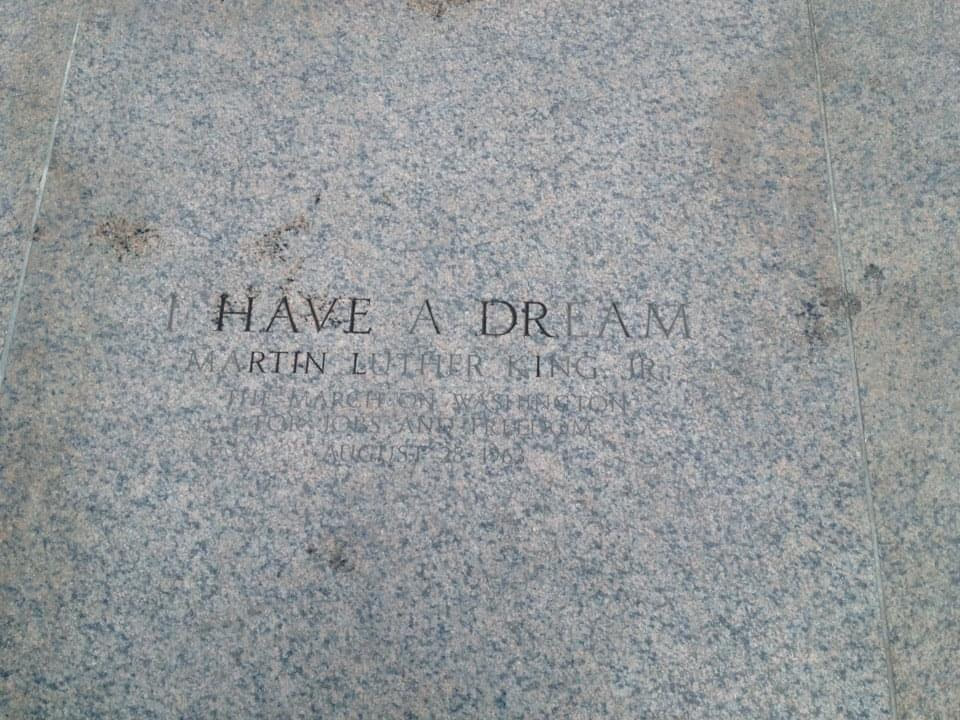

From 2005 to 2007 Kurt was named an Ohio Rising Star Super Lawyer, which is for the 2.5% of attorneys in an area of practice under the age of 40. Kurt sadly "aged out" of that category in 2008. Congrats again boss, and as we joke with you every year, no you can't wear a cape to work. Our office will close Monday January 15, 2024. Today, I want to talk about why Martin Luther King Day is so important to celebrate. We know it's a day off for many, including all government agencies we deal with. But it's so much more than that. This day is all about honoring the incredible legacy of Dr. Martin Luther King Jr. and the ongoing fight for equality and justice.

First off, Martin Luther King Day is a time to remember and reflect on the life and work of Dr. King. He was a powerful voice in the civil rights movement, advocating for nonviolent activism and equality for all people. His tireless efforts paved the way for significant changes in our society, and his words continue to inspire generations. Moreover, celebrating this day is a way to recognize the progress that has been made in the fight for civil rights and social justice. It's a reminder that change is possible, and that each of us has a role to play in creating a more inclusive and equitable world. Additionally, Martin Luther King Day serves as a call to action. It's time to consider how we can contribute to Dr. King's vision of a more just and harmonious society. Whether it's through volunteering, advocating for policy changes, or simply having meaningful conversations, each of us can make a difference. Finally, this day is a chance to celebrate diversity and unity. Dr. King's message of love, compassion, and understanding is as relevant today as it was during the civil rights era. By coming together to honor his legacy, we reaffirm our commitment to building a society where everyone is valued and respected. So, as we enjoy the day off, let's also take a moment to appreciate the significance of Martin Luther King Day. It's a time to remember, reflect, and recommit ourselves to the ongoing pursuit of equality and justice for all. Fifty-six years ago this week, our boss, Kurt Young, was born. Kurt's parents, James Young and Mary Anne (formerly Schultz), were high school sweethearts. His dad was supposed to go to college and play football for the University of Michigan, but due to a car accident and on-field injuries, he couldn't pass his scholarship physical. Instead, he joined the US Navy and served for over 20 years. Because of his dad's service, Kurt lived everywhere but Toledo for his first 25 years of life. He followed his dad from Newport, Rhode Island, to Detroit, Michigan, to San Juan, Puerto Rico, to Norfolk, Virginia, and finally to Akron, Ohio. Kurt finished high school and college in Akron, then moved to Cleveland for law school and his first year of practice. Finally, he returned to the Toledo area. In 1997, Kurt married Cheri, and his adventure as a pastor's spouse began. Cheri was helping with a church turnaround or revitalization in Findlay, Ohio, when they married. Kurt was part of a team that started a cutting-edge worship service at that church. He then helped Cheri revitalize another church and start one from scratch. Kurt has undergone extensive training in worship planning, church marketing, and starting new churches. He is still actively involved in his church today. Kurt's favorite job, outside of the firm, is being a father. He and Cheri have a daughter, Rebecca, and a son, James. They raised them in Toledo's Old West End and have all been active in that community and non-profit organizations advocating for the LGBTQ community, combating youth homelessness, and promoting voting Kurt holds an undergraduate degree with a certification in campaign and interest group management. He has worked as an intern on Congressional campaigns, in a Congressional District Office, and in the Mayor of Akron's office, assisting with intergovernmental lobbying. He has been actively involved in campaigns since the age of 12, holding various positions such as volunteer coordinator, targeting director, general counsel, and campaign manager. Additionally, he was appointed to a term on the Toledo City Council. Kurt has been actively engaged in Democratic Politics across Summit, Cuyahoga, Wood, and Lucas Counties. He has served on the Central Committees of Cuyahoga and Lucas County, as well as on the Executive Committees of Summit, Wood, and Lucas Counties, and the Ohio Democratic Party. He is a strong advocate for programs benefiting young political operatives, having held positions such as President of the University of Akron College Dems and a Young Dem in Summit, Cuyahoga, and Wood Counties. In recognition of his dedication, he was bestowed the title of Honorary University of Toledo College Democrat for Life in 2012, as well as an Honorary Lucas County Young Democrat. In 2022, the Lucas County Young Democrats renamed the award to the "Kurt Forever Young Honorary Lucas County Young Dem for Life." Moreover, he served as the Parliamentarian of the Lucas County Democratic Central and Executive Committees and later became the Chair of the Lucas County Democratic Party. After the 2000 election debacle in Florida, Kurt helped found the Lucas County Democratic Promote the Vote Team. He trained and deployed hundreds of attorneys and other volunteers as election observers, protecting the voting rights of thousands of voters. He has been named by the County and Ohio Democratic Party as the Board of Elections, also known as the "Super Observer," in over a dozen counties. For almost a decade, Kurt and our team have hosted the Toledo Area Jobs with Justice/Interfaith Worker Justice Ride to the Polls effort, providing thousands of Toledo area voters with free rides to the polls. In 2019, Kurt was appointed as one of the four members of the Lucas County Board of Elections. This year, he became the first Democrat to be reappointed to a second term in decades. He is also a member of the Ohio Association of Election Officials. Kurt has been an active attorney since November 1993. He is licensed to practice in Ohio, the Federal District Court for the Northern District of Ohio, and the Supreme Court of the United States. Twenty years ago this March, Kurt started the Law Offices of Kurt M. Young, LLC. With the help of added attorneys, paralegals, and secretaries, they have assisted thousands of working people in obtaining the legal help they need. So, Happy Birthday, Kurt! |

Archives

January 2024

Categories |

Areas of Practice |

Our Office |

Contact Information

© COPYRIGHT 2024. ALL RIGHTS RESERVED.

|

RSS Feed

RSS Feed